blog

How to Handle Health Plan Membership Data

SECTIONS

The way you handle your health plan data plays a central role in how well you can serve your members overall. With a strong data management strategy in place, you can be more efficient, build trust through transparency with members, and enhance important outcomes.

Without one, you’re at high risk of experiencing adverse events like data breaches or error-prone service and benefits administration, which can have dire consequences for your organization.

So how do you handle health plan membership data effectively? What are the critical tools, actions, and considerations you need to prioritize? That’s what we’ll cover in this guide.

Key Takeaways:

- Health plan membership data includes a variety of information, such as: demographics, member ID numbers, benefits details, and payments/claims histories.

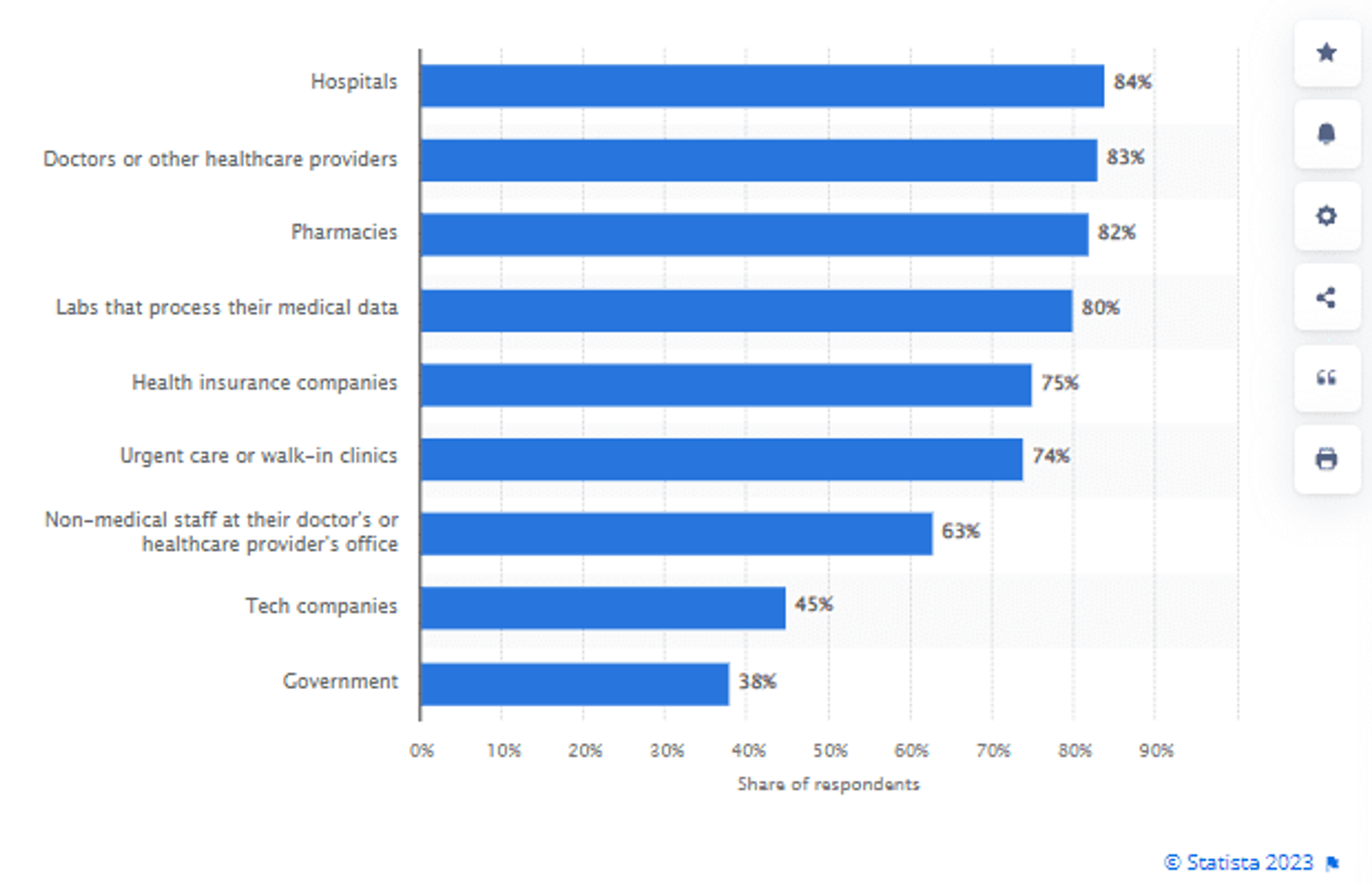

- Trust is paramount when it comes to handling member data. Today, about 75% of people say they trust their insurance providers to handle their data.

- Data security and legal compliance must be prioritized in every data-related interaction.

- Health plan data analytics can be used to personalize experiences, identify trends, and optimize coverage and outcomes.

- The scope and volume of healthcare data today requires the support of automated and AI-driven data management tools.

What is Health Plan Membership Data?

Before we dive into how to manage health plan membership data and why it matters, it’s important to understand its full scope. By definition, health plan membership data refers to any data and records that are related to the individuals enrolled in a specific health insurance plan or program.

Types of information it includes are:

Member Demographics

Demographics include basic information about each member, such as their name, date of birth, gender, address, and contact details. This information is used for identification and communication purposes.

Enrollment Information

Enrollment information details when a member enrolled in the health plan, including the enrollment date, coverage start date, and any changes or updates to their enrollment status. This information helps the health plan track membership changes over time.

Member Identification Numbers

Unique identification numbers or codes are assigned to each member for easy tracking and reference within the health plan’s system. These numbers are often used for billing and claims processing.

Dependent Information

If applicable, information about any dependents covered under the member’s plan are also recorded, including names, dates of birth, and relationships to the primary member (e.g., spouse, children).

Benefits Coverage

Benefits coverage information includes the specific benefits and coverage provided to each member, outlining details about what medical services and treatments are covered, co-pays, deductibles, and any limitations or exclusions in their coverage.

Premium Payments

Records are kept to track premium payments made by the member or their employer. This information is essential for monitoring payment status and ensuring continued coverage.

Claims History

Detailed records must be kept about the healthcare services and treatments members have received and for which claims have been submitted. This data is crucial for claims processing and tracking benefits utilization.

Provider Network

This encompasses information about the healthcare providers and facilities that are part of the health plan’s network. It helps members find in-network providers and ensures accurate billing and reimbursement.

Plan Changes and Terminations

Records must be kept of any changes to a member’s health plan, such as switching to a different plan within the same insurance provider or changing coverage options, as well as terminations. This data is essential for maintaining an accurate list of current members.

Why Is Managing Health Plan Membership Data So Important?

Given the scope and volume of health plan data that companies process daily, it’s essential to have an intentional strategy in place for effective data management. Not only does this enable efficient service and operations, it’s key to building successful member relationships.

Members know that sharing their information is a standard part of receiving healthcare in our modern world. But they still aren’t 100% comfortable with all of the organizations that have to handle and share it throughout the healthcare ecosystem.

Today, 75% of peopleOpens in a new tab say they trust health insurance companies to keep their data safe. A clear majority, but still not a consensus.

Equally important to keep in mind is that insurance companies have to interact and share data with many other people and organizations in the healthcare ecosystem—some of which members may trust at a lower rate.

Image Source

It’s critical that your protocols and processes for managing health plan membership data considers how to keep member data safe during these interactions to promote trust with your members about how and why their data is used in certain ways.

At the same time, your data management practices must contain modern methods, tools, and standards to ensure data is accurate and secure at all times, driving successful financial, legal, and strategic outcomes for your company.

Let’s look at 9 key steps to managing health plan membership data effectively in practice.

How to Handle Health Plan Data: 9 Key Steps

1. Establish Data Accuracy Protocols

Begin by capturing precise member information during enrollment. Implement validation checks to ensure data completeness and accuracy. Accurate data entry forms the foundation of reliable health plan membership data.

Regularly update member details and maintain a process for your members to submit changes whenever necessary. Keep data up-to-date to enable informed decision-making and efficient communication.

2. Centralize Data Management

Maintain a centralized database for storing membership data. Maintaining a centralized member data repository minimizes redundancy and streamlines access. It also enhances data security by consolidating sensitive information into a well-protected repository.

3. Prioritize Data Security and Compliance

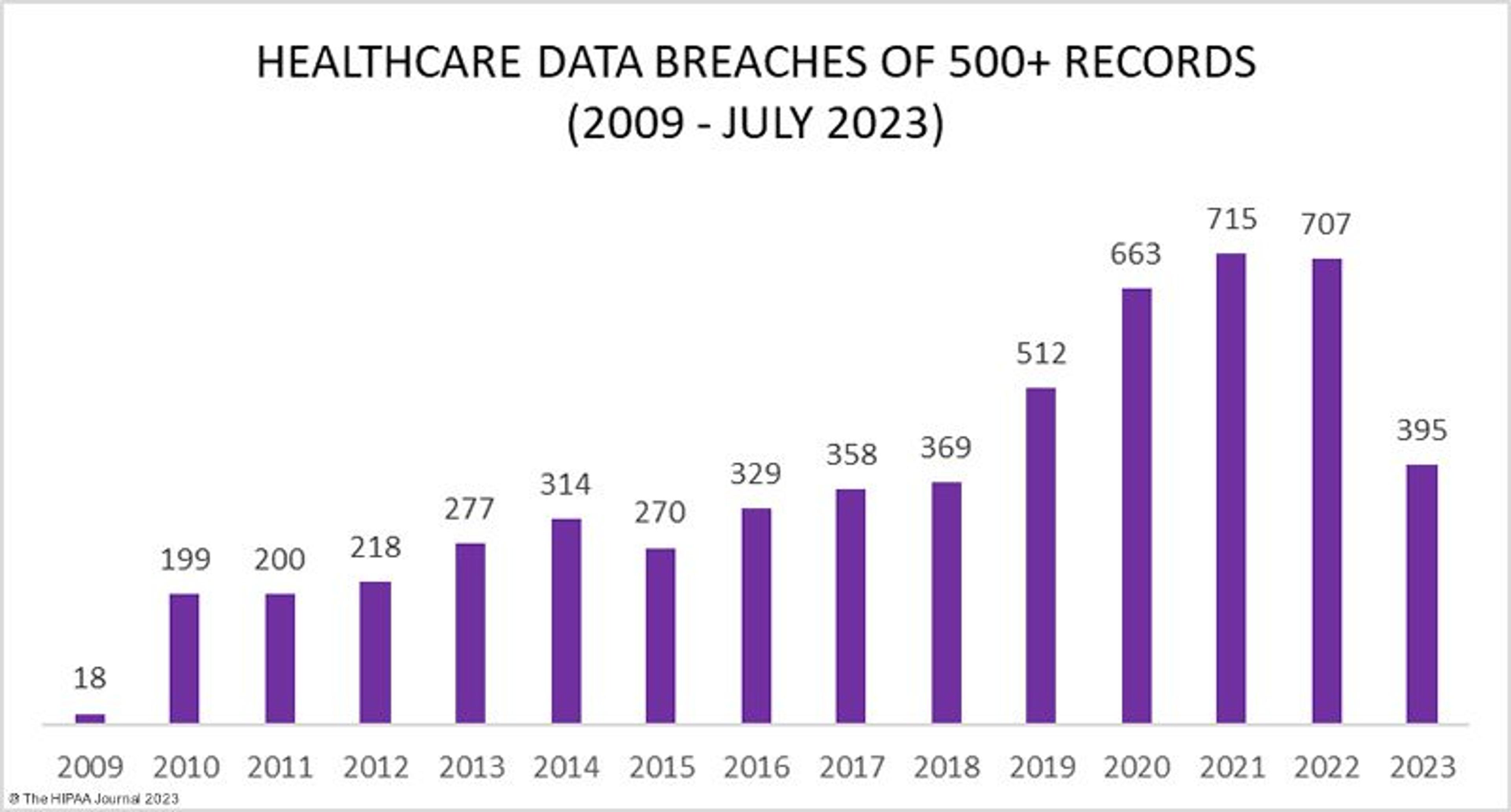

Speaking of data security, it must be at the forefront of your strategy. Healthcare data breaches have been steadily on the rise over the past decade, and are set to outpaceOpens in a new tab their 2022 total.

Image Source

It’s crucial to do everything possible to prevent member data from being compromised. Comply with data privacy regulations, such as HIPAA and GDPR, and train your staff on how to handle member data appropriately in various situations.

Be sure also to employ strong encryption, access controls, and regular security assessments to safeguard member data across your IT systems. Protecting sensitive information is a non-negotiable for maintaining trust with your members and legal compliance for your organization.

4. Personalize Member Communication

One of the best ways to leverage health plan membership data is to use it for personalizing interactions and member experiences. Coupled with the right technology tools, you can do things like send targeted updates and reminders or share content that may interest specific members.

This kind of personalized communication promotes key outcomes like higher patient adherence, better member engagement, and greater member satisfaction with their service and care.

5. Integrate Data and Analytics

Data analytics plays a key role in data management. Leverage analytics tools to analyze patterns and identify trends, then use them to optimize coverage, identify areas for improvement, and make more data-driven decisions on a daily basis.

6. Perform Regular Data Audits

Conduct periodic audits of your health plan data for discrepancies, errors, or potential fraud. Swiftly address issues to maintain data accuracy and trustworthiness. Routine quality checks ensure that your data remains reliable for decision-making and reporting.

7. Enable Member Self-Service

Provide your members with secure access to their data online, allowing them to review coverage details, claims history, and premium payments. Empowering members with access fosters transparency, reduces administrative load, and promotes more proactive health management.

8. Adhere to Data Retention Policies

Develop and enforce data retention policies aligned with regulatory requirements. Delete or archive outdated records to streamline data management, reduce risks, and maintain compliance. Effective data retention practices prevent clutter and maintain data relevance.

9. Train Your Staff

Ensure that staff members who handle membership data are well-trained on data privacy regulations and best practices. Knowledgeable staff are essential to maintain data security and compliance, as well as to foster a culture of data protection.

Uplevel Your Health Plan Data Management with MDM

The thing about effective health plan data management in our fast-moving and highly digital world is that it can’t be done by humans alone. There’s too much data to handle, and it needs to be shared too widely to be managed without the help of automated, AI-driven data management tools.

Master data management (MDM) tools help you centralize critical member data (i.e. personal identifying information, medical histories, prescription plans, etc.) into a single, authoritative source for master data, facilitating data sharing across the organization and supporting better decision-making, compliance, and operational efficiency.

MDM platforms can also help you maintain a holistic view of your member data, enabling you to harness the full potential of their information assets to deliver better service and benefits.

Gaine’s Coperer platform is a highly scalable and ecosystem-wide MDM solution specifically designed for the unique challenges of the healthcare and life sciences industries.

Watch a quick demo of Coperer to learn how Gaine can help your organization transform its data management strategy.